As the landscape of online payments rapidly evolves, businesses must be equipped with the right tools to manage transactions securely and efficiently. For those businesses that are remote and use physical credit cards, following a virtual terminal online and a credit card vault will change the whole approach to the method of payment you are receiving. These technologies improve the customer experience while also strengthening security and compliance.

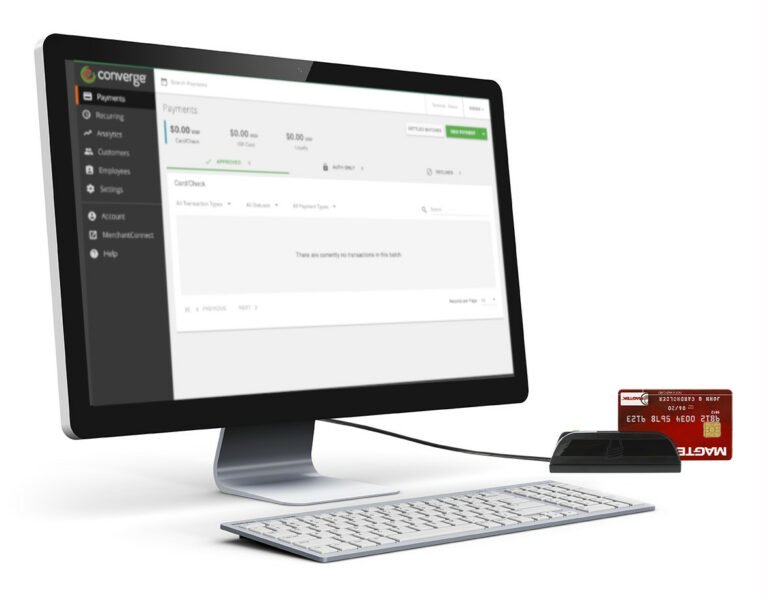

What is a Virtual Terminal Online?

An online virtual terminal is a web-based payment processing tool that enables businesses to manually process credit card transactions. It removes the requirement for physical hardware such as card readers, which means that payments can be accepted from anywhere at present with internet access.

This is especially useful for businesses that receive orders by phone, email, or other remote channels.

Benefits of a Virtual Terminal Online:

Flexibility: Play it safe and do things your way.

Cost-Effectiveness: There is no need for any costly hardware or equipment, acting as a great way to save on overhead costs.

Friendly: Intuitive interfaces allow you to handle payments fast and error-free.

Wide-ranging Use Cases — Perfect for business sectors such as hospitality, healthcare, and retail that tend to deal with remote/handwritten transactions.

This means that with a virtual terminal online, no sale needs to be lost, even if the customer is at home.

What Is a Credit Card Vault?

A credit card vault is an additional layer of security between your transaction and your customer payment information. This tool is essential for automotive businesses that rely on recurring transactions like subscription services or wish to create a more convenient checkout experience for returning customers.

The Why a credit card vault is important:

Security: Sensitive member data is encrypted and stored securely, minimizing fraud and breaches.

Compliance : Compliance with PCI-DSS standards helps businesses to comply with regulatory needs to store payment information.

Applicable: Customers do not have to input their payment information for every transaction. This makes the customer experience better.

Time-Saving: Stored Data for Automatic Payments

For businesses that are subscription-based or frequently serve returning customers, a credit card vault is a must-have for providing a friction-free service.

How These Tools Work Together

Thus, a virtual terminal online + credit card vault = a top-notch payment ecosystem! The virtual terminal allows them to manually process transactions while the vault securely stores the payment details for future use. The best for this combination is:

Setting up recurring payments to be automatic

Managing high volumes of remote transactions

Creating a secure and seamless experience for returns for businesses and customers alike.

Benefits of Integration:

Better Customer Experience: Provide fast and hassle-free transactions to repeat customers.

Increased Security: HKID is encrypted and stored, minimizing potential for fraud.

Enhanced: Streamlining & Automation Automating repetitive tasks, such as monthly billing, allows you more time to focus on other priorities.

Scalability: As business grows, these solutions easily accommodate increased transaction volumes.

Choosing the Right Provider

Leveraging these tools does involve finding a provider that is security-focused, reliable, and easy-to-use. Look for solutions that:

FACEBOOK MEET PCI Compliance For Secure Payment Processing

Provide easy integration with your existing systems.

Offer leading-edge anti-fraud protections and encryption technologies.

Allow your customer to pay on many different ways.

Providers like RapidCents have built a loyal following for their secure and scalable solutions, which incorporate both a credit card vault and virtual terminal capabilities. These solutions leverage intuitive design and strong encryption to enable organizations to process transactions securely.

Conclusion

Incorporating both a virtual terminal online and a credit card vault will allow businesses to process transactions safely and conveniently. From receiving remote payments, managing recurring transactions, and keeping data secure, these bad boys are essential in maximizing your customer experience and business productivity.

Incorporating these technologies will help you simplify payment processes, minimize risks, and make your business ready for sustainable growth. Increase the effectiveness of your payment operations by opting for trusted providers like RapidCents.