Hook: Imagine holding a piece of history forged over billions of years in distant supernovae – that’s the essence of gold. But in today’s lightning-fast markets, knowing its exact value right now is more crucial than ever. Where do savvy investors turn to catch every shimmer and dip? For countless eyes tracking the heartbeat of the yellow metal, the answer is fintechzoom.com gold price. This isn’t just a number; it’s a dynamic gateway to understanding global economic currents and making informed moves in the precious metals arena.

Why Tracking Gold Prices Matters More Than Ever

Gold isn’t just a shiny relic. It’s a financial barometer, reacting sharply to the world’s economic weather. Think of it like this:

- Inflation Hedge: When money loses value (inflation), gold often shines brighter. People flock to it as a ‘real asset’ store of value.

- Safe Haven: Geopolitical tensions flare? Stock markets tumble? Gold frequently becomes the port in the storm.

- Interest Rate Mirror: Rising interest rates can make holding non-yielding gold less attractive. Falling rates? Gold often gets a boost.

- Currency Counterweight: When the US dollar weakens, gold priced in dollars usually strengthens, and vice-versa.

Simply knowing the price isn’t enough. You need context, trends, and tools to interpret what that price means. That’s where a platform like fintechzoom.com gold price steps in, transforming raw data into actionable intelligence.

How FintechZoom.com Gold Price Cuts Through the Noise

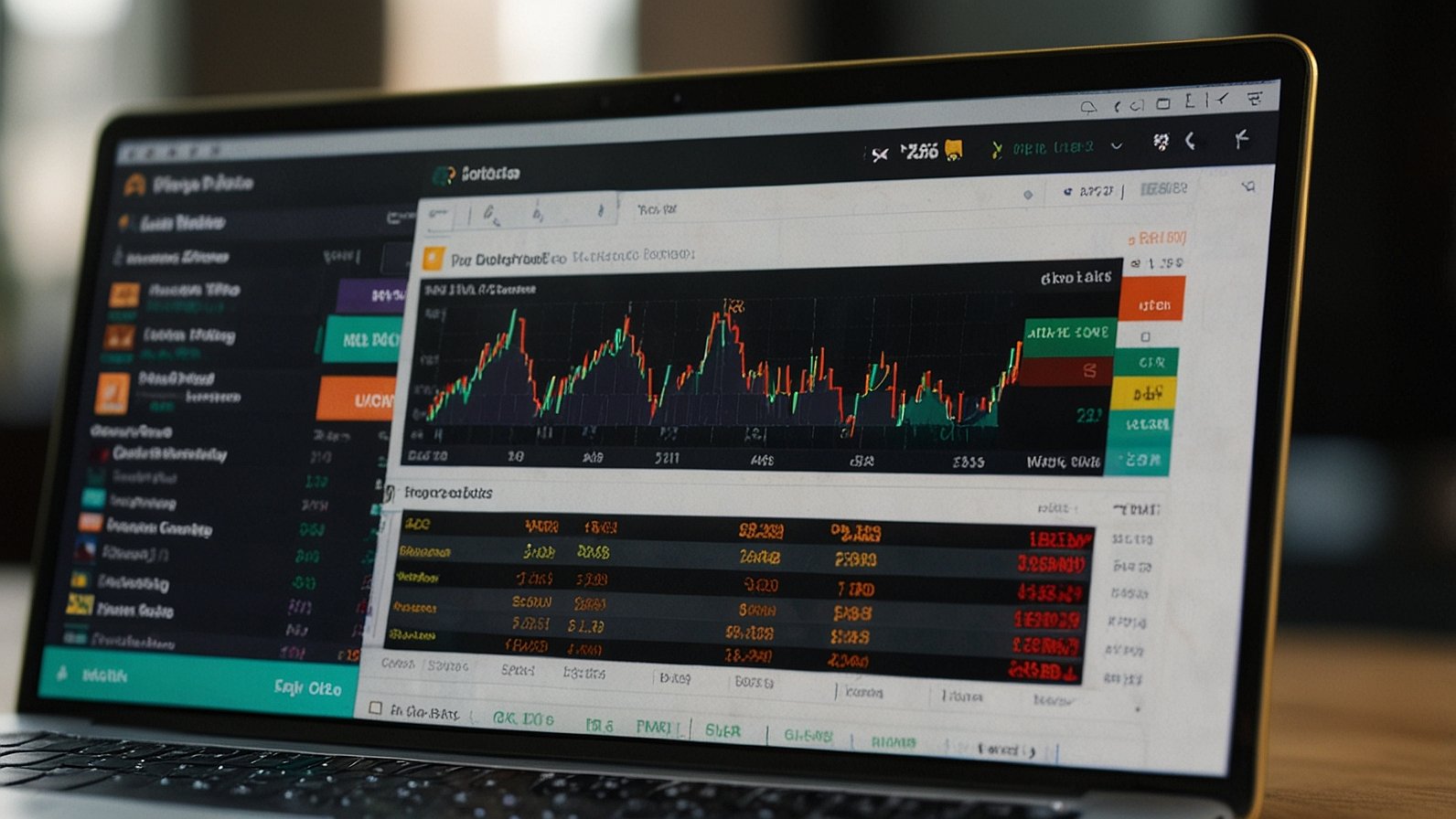

Forget scrambling between multiple sources. Fintechzoom.com gold price acts as your centralized command center for all things gold. It aggregates live spot prices from major global commodities exchanges (like COMEX, LBMA) and benchmark auctions, ensuring you’re seeing the most accurate, real-time reflection of the market.

Here’s what makes it a standout resource:

- Real-Time Spot Prices, Globally Relevant: See the price per ounce not just in USD, but often in EUR, GBP, JPY, AUD, CAD, and more. Instantly grasp how currency fluctuations impact gold’s value in your local context.

- Interactive, Insightful Charts: Static numbers tell part of the story. FintechZoom’s dynamic charts let you:

- Zoom in on minutes, hours, days, weeks, months, or years.

- Overlay critical technical indicators (like 50-day or 200-day moving averages – think of these as trend identifiers).

- Identify key support (price floor) and resistance (price ceiling) levels, crucial for timing entry or exit points.

- Compare gold’s performance against other assets (like major stock indices or silver).

- Deep Historical Data: Want to see how gold reacted during the 2008 crash, the 2020 pandemic surge, or last year’s inflation spike? Comprehensive historical data allows for powerful trend analysis and pattern recognition.

- Expert Analysis & Forecasts: Beyond the numbers, FintechZoom provides context. Their analysts break down why gold is moving:

- Macro Drivers: How did the latest Fed rate decision, CPI inflation report, or geopolitical event (e.g., Ukraine conflict, Middle East tensions) impact sentiment?

- Market Sentiment: Are investors fearful or greedy? What’s the flow into gold ETFs?

- Forward-Looking Projections: What are analysts predicting for gold in the next quarter or year based on current economic trajectories?

| Feature | Benefit for You |

|---|---|

| Live Spot Prices (Multi-Currency) | See the exact, current market value relevant to your location. |

| Interactive Charts with Technical Tools | Visualize trends, spot patterns, identify key levels for better decision-making. |

| Comprehensive Historical Data | Analyze long-term performance and understand gold’s behavior in different economic climates. |

| Macroeconomic & Geopolitical Analysis | Understand the “why” behind price movements. |

| Expert Forecasts | Gain insights into potential future price directions. |

| Customizable Price Alerts | Never miss a crucial move; get notified instantly when your target price is hit. |

Also Read: FintechZoom.com Crypto Market Cap: Your Ultimate Guide to Navigating the Digital Gold Rush

Your Secret Weapon: Customizable Price Alerts

Market volatility can be brutal. One minute gold is steady, the next it surges or plunges on unexpected news. Manually watching the screen 24/7 isn’t practical. This is where fintechzoom.com gold price truly empowers you: customizable price alerts.

- Set alerts for specific price levels (e.g., “Alert me if gold hits $2,400/oz” or “Alert me if gold drops below $1,900/oz”).

- Get notified instantly via email or SMS (depending on platform features).

- This allows for proactive risk management and timely execution of your strategy, whether you’re looking to buy the dip, lock in profits, or simply stay informed of significant breakouts.

Think of these alerts as your personal market sentinel, always on duty.

Making Smarter Moves: From Data to Decision

So, how does a regular investor actually use fintechzoom.com gold price?

- The Newcomer: “Is now a good time to buy?” Check the current trend (up/down/sideways) on the chart. Read the latest analysis on inflation and interest rates. Look at the 200-day moving average – is the price above (bullish) or below (bearish)? Set a price alert for a potential entry point lower than the current price.

- The Seasoned Trader: “Is this resistance level strong?” Analyze volume and price action near the level on the interactive chart. Check if a major economic report is due that could trigger a breakout. Set tight alerts above resistance (for a potential breakout buy) or below support (for a potential breakdown sell).

- The Long-Term Holder: “Should I rebalance my portfolio?” Review long-term charts and historical performance during similar economic periods. Read expert forecasts for the next 1-5 years. Use the platform to monitor overall allocation without needing constant, active trading.

Real-World Example: Remember March 2020? Pandemic panic sent stocks crashing. Savvy investors monitoring fintechzoom.com gold price saw gold initially dip but then surge dramatically as a safe haven. Those with alerts set for key upside breakout levels could have captured significant gains as gold raced upwards.

The Future of Gold & Your Financial Compass

The global economic landscape remains complex – persistent inflation concerns, shifting interest rate policies, ongoing geopolitical friction. In this environment, gold’s role as a diversifier and potential hedge is unlikely to diminish. Tools that provide real-time data, insightful analysis, and proactive alerts are no longer luxuries; they are essentials for navigating uncertainty.

Fintechzoom.com gold price puts that essential toolkit at your fingertips. It democratizes access to the kind of market intelligence once reserved for institutional players, leveling the playing field for individual investors.

Your Gold Tracking Action Plan: 3 Steps to Start Today

- Bookmark & Check Daily: Make fintechzoom.com gold price part of your morning market routine. Glance at the spot price and chart trend.

- Set Your First Alert: Identify one key price level relevant to your strategy (e.g., a price you’d like to buy at or a profit target). Set an alert!

- Read One Analysis Piece Weekly: Dive into their expert commentary. Focus on understanding one macroeconomic driver impacting gold that week (e.g., the latest Fed statement, a key jobs report).

Ready to take control of your gold strategy? How will you use real-time data and insights to navigate the precious metals market today?

You May Also Read: Crypto Staking for Beginners: How to Start Earning in 2025

FAQs

How often is the gold price updated on FintechZoom?

The spot price is typically updated in real-time or with minimal latency (seconds), reflecting the current market bid/ask from major exchanges.

Do I need an account to see the gold price on FintechZoom?

Usually, the live spot price and basic charts are freely accessible without an account. However, features like advanced technical indicators, in-depth historical data, full expert analysis, and setting price alerts may require registration for a free or premium account.

Can I access FintechZoom gold prices on my phone?

Absolutely! FintechZoom.com is a web-based platform designed to be responsive and functional on mobile browsers. They may also offer dedicated mobile apps (check your app store) for even more convenient access to live prices and alerts on the go.

Where does FintechZoom get its gold price data and analysis?

They aggregate live spot prices from major, reputable global commodities exchanges (like COMEX in New York or the LBMA in London) and benchmark auctions. Their analysis is typically provided by in-house financial experts or sourced from experienced market commentators, interpreting data based on macroeconomic trends and technical analysis.

Are the price alerts reliable?

Alerts are generally reliable as they are triggered by the platform’s live data feed. However, extreme market volatility (“flash crashes” or “spikes”) can sometimes cause very brief deviations where the price touches your level and reverses before you can act. They are best used as signals, not guarantees of execution at that exact price.

Does FintechZoom cover other precious metals besides gold?

Yes, most comprehensive financial platforms like FintechZoom also track live prices and provide analysis for silver, platinum, and palladium.

Is FintechZoom’s gold price suitable for physical bullion buyers?

Yes, the spot price is the fundamental benchmark for physical bullion (bars, coins). Dealers add premiums (manufacturing, distribution, profit) on top of the spot price. Monitoring fintechzoom.com gold price helps you understand the underlying market value before purchasing physical gold.